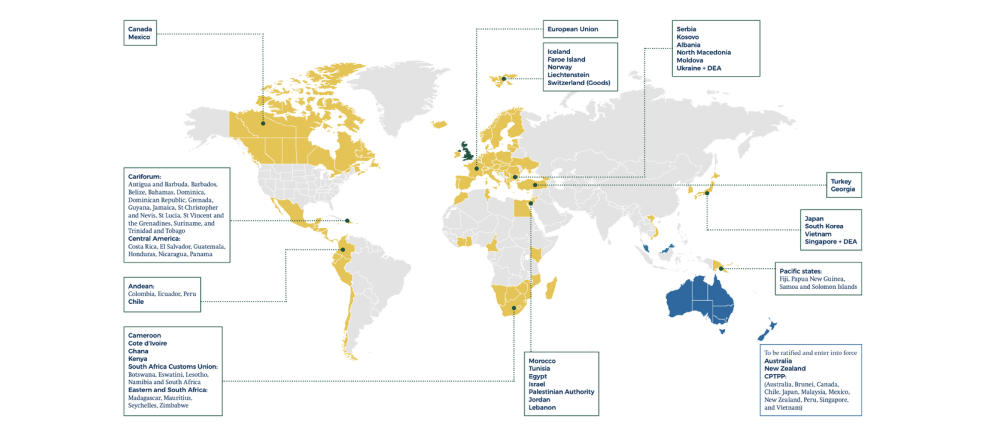

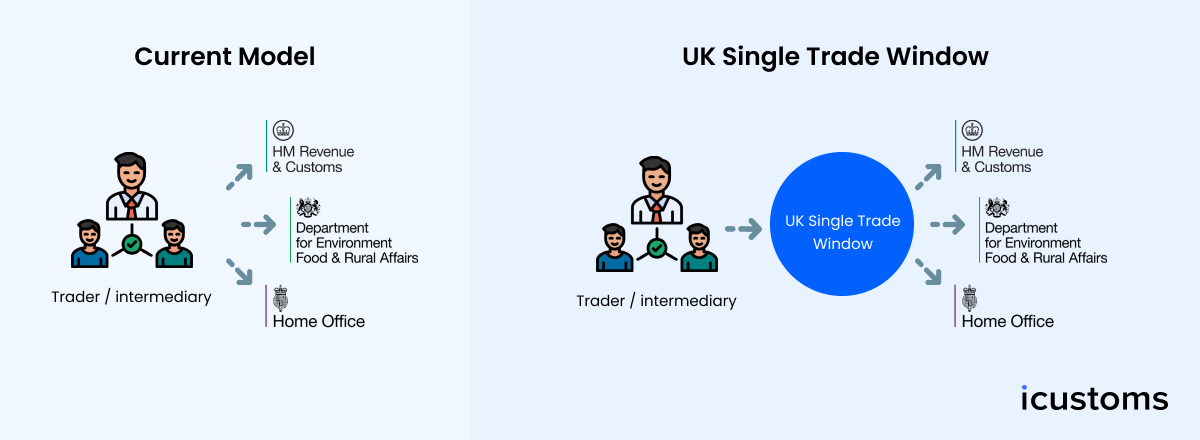

Free Trade Agreement Compliance Strategies: A Must Read for UK Businesses International trade is controlled by a variety of laws, regulations, and trade agreements, and meeting these standards is critical for enterprises involved in global trade. There is no exception with free trade agreements (FTAs), and firms in the UK who want to benefit from… Continue reading Free Trade Agreement Compliance Strategies for UK Businesses

Free Trade Agreement Compliance Strategies for UK Businesses