Landed Cost Calculator

Get smart with duty & tax calculation

Automate the calculation of customs duties, taxes, and other charges to save time, avoid delays, and evade paying extra costs through our landed cost calculator.

Drive traffic to your website

With our smart import duty calculator, you can attract a steady stream of qualified visitors and boost your website’s ranking.

Bulk calculation & seamless integration

Calculate import duties and taxes for huge volumes of data quickly and accurately. Our smart calculator integrates with ERP, CRM, and other company tools for speedy calculation.

For bulk calculation and integration service contact our team…

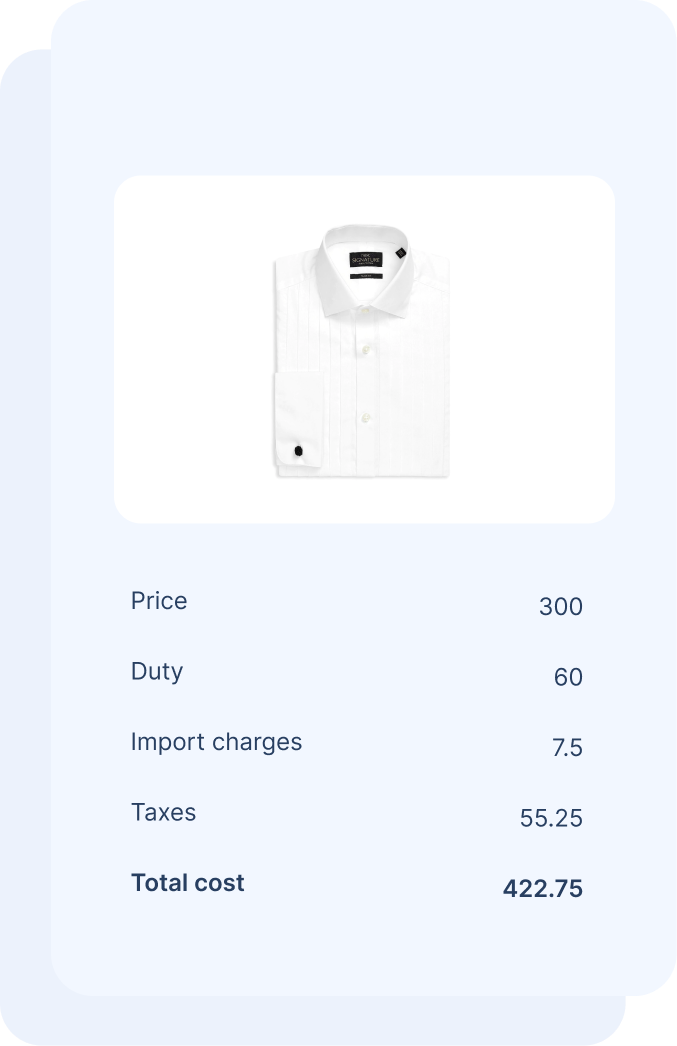

Landed Cost Calculator

Get the accurate results of tax calculation for import duty estimation using tariff and product description by using our landed cost calculator.

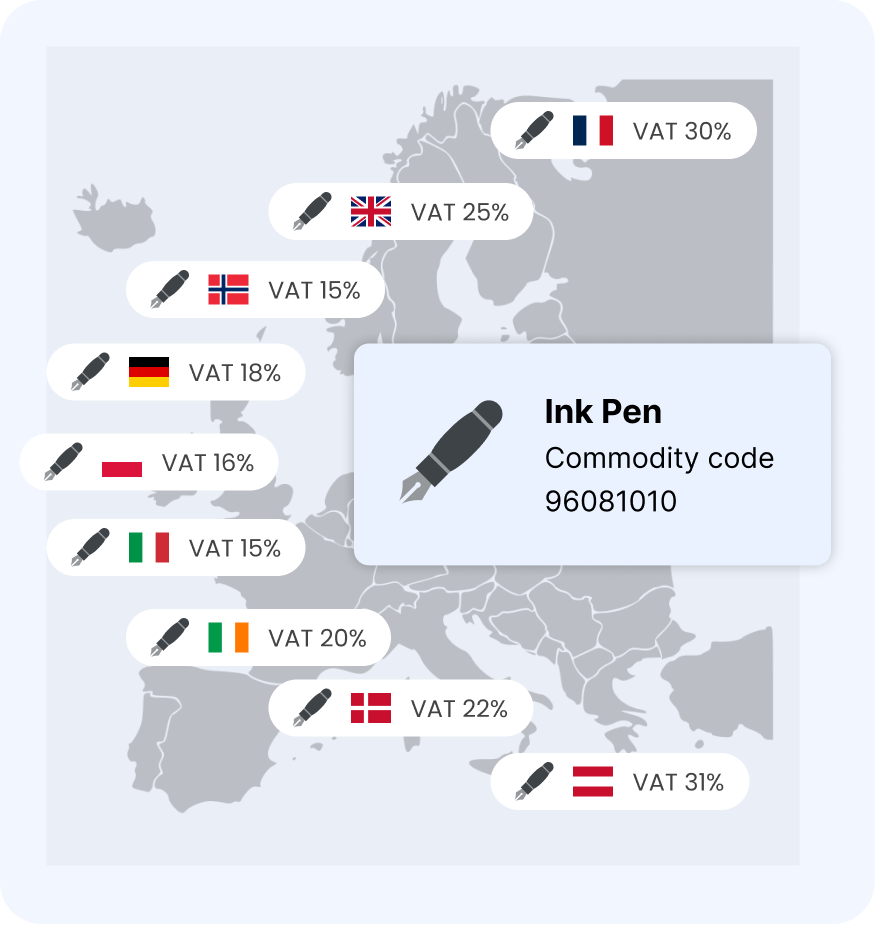

UK Integrated Online Tariff

Best match Products Name or products description , you can select any of them to check and calculate duty rate, VAT rate and total landed cost.

- Searching...

This tariff information is for the UK only