Seven Facts You Must Know About Entry in Declarant's Records (EIDR)

Entry in Declarant’s Records (EIDR), controlled by the Union Customs Code (UCC) in the European Union, is a mandatory obligation for declaring imported or exported goods.

It comprises submitting a full declaration that includes information about the items, such as the type of product, the amount, the value, the country of origin or destination, and other key UCC-mandated details. Compliance with EIDR is required in order to clear goods under the UCC. Failure to meet this standard may result in fines or clearance delays.

Most of the time, a customs declaration system (CDS) facilitates this procedure online. The UCC also requires that EIDR be conducted in accordance with the forms and guidelines established by the EU. By ensuring a seamless and uniform procedure across the EU, this reduces the need for additional administrative work.

A deep dive into Entry in Declarant’s Records (EIDR)

The Union Customs Code introduces a new convenience called Entry in Declarant’s Records (EIDR). Economic operators in the European Union (EU) can release goods to a customs procedure with the use of a condensed data set and an entry in their electronic business records without having to file a comprehensive customs declaration at the time of release.

It could be necessary to incorporate all financial and statistical information in a later declaration. You need to let HMRC know that you used EIDR customs to disclose your things to a customs procedure.

Key Points to Understand About EIDR

EIDR UK: Monitoring and Tracking Products in Custom UK

Entry in Declarant’s Records (EIDR) is a system that helps customs in the United Kingdom keep track of everything that comes into and goes out of the nation. In this system, every batch of items is assigned a unique code. Similar to a label, that code aids in the tracking of the products during the customs procedure. It provides information about the type of product, its value, and the person receiving or shipping it.

Significance of EIDR in Custom Declaration

To follow the rules, customs paperwork must be filled out every time something enters or leaves the UK. This EIDR mechanism ensures that everyone abides by the regulations. It is significant because it guarantees the proper execution of all necessary customs processes and the payment of all applicable taxes and fees. This entails completing the appropriate paperwork and ensuring that any charges or taxes associated with receiving or shipping goods are paid.

EIDR: Ensuring Compliance and Safety

Furthermore, there is more to this system than paperwork. It also aids in monitoring other critical regulations, such as ensuring that hazardous goods or substances requiring special authorisation are not entering or leaving without the necessary verifications. The EIDR’s unique code facilitates the proper matching of the items with the appropriate customs documentation. Prior to the official entry or exit of items, the appropriate customs documentation bearing the EIDR code must be completed and submitted to the relevant authorities.

Seven Facts You Must Know about Entry in Declarant's Records (EIDR)

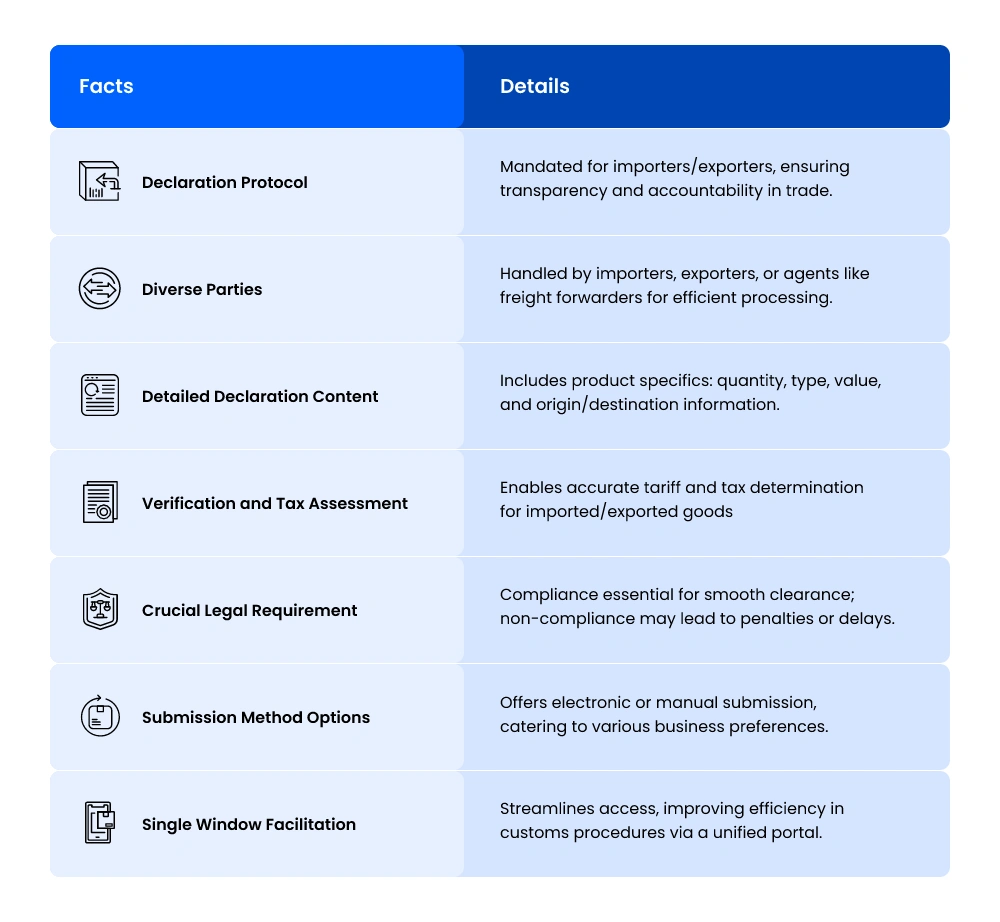

Here are seven facts you must know about entry in declarant’s records (EIDR):

Required Declaration Protocol

Entry in Declarant’s Records (EIDR) is a crucial procedure that customs officials require of all parties engaged in the import or export of commodities. It guarantees an accountable and transparent approach to global trade operations.

Diverse Parties

Although importers and exporters usually control the EIDR, agencies such as freight forwarders or customs officers may also take charge of it on their behalf. This adaptability makes processing customs declarations efficient.

Detailed Declaration Content

The EIDR process entails filing a detailed declaration that includes all relevant product details, such as numbers, type, value, and essential details on the origin or destination of the goods

Verification and Tax Assessment

EIDR is used by customs officials to double-check and confirm the accuracy of the declaration data. This verification procedure is critical for determining the correct tariffs and taxes that apply to imported or exported items.

Crucial Legal Requirement

EIDR compliance is essential to the efficient clearing of goods. Failure to comply might result in penalties or delays, emphasising the necessity of compliance in the customs clearance procedure.

Submission Method Options

EIDR provides both electronic and manual submission options. To accommodate different business preferences, it can be conducted manually using conventional paper documents or electronically utilising a customs declaration system.

Single Window Facilitation

A number of nations have adopted the “Single Window” strategy, which gives various government entities access to EIDR via a single, centralised portal. This simplified access promotes efficiency, lowers bureaucratic barriers, and accelerates custom declaration.

Takeaway

To sum up, the EIDR system is a crucial component of UK Customs Declaration processes and is a tool used by UK customs officials to track the shipment of products through the customs clearing process. EIDR guarantees compliance with relevant laws and customs rules pertaining to the import and export of products by giving distinctive identities to shipments. This identification helps customs officials match shipments to the appropriate customs declarations so they can confirm that all applicable taxes and duties have been paid before approving an import or export.

Seeking for more efficient procedures for customs declarations? Discover how simple it is to handle Entry in Declarant’s Records (EIDR) with iCustoms. Our customised solutions expedite the EIDR process, guaranteeing precise declarations and prompt approval. Partner with iCustoms for hassle-free EIDR management to increase the effectiveness of your import and export processes.

So get your journey started and book a demo.

FAQS's

Who is the Declarant on a Customs Declaration?

The declarant is the person or organisation in charge of supplying the necessary information and filing the customs declaration to customs authorities.

What is the Entry in Declarant's Records UK?

Entry in Declarant's Records (EIDR) in the United Kingdom entails directly entering imported or exported items in the records of an authorised company, simplifying expedited customs processing.

Is the Declarant the Importer of Record?

The declarant is not usually the importer of record; they are in charge of filling out the customs declaration, whilst the importer of record is in charge of meeting import criteria and paying charges.

What is the Difference Between a Declarant and an Importer?

The declarant makes and submits the customs declaration, whereas the importer is legally liable for the imported items, including duty payment and compliance with import laws. They can be the same entity, yet they frequently play different roles in customs processes.