AIS Explained: A Guide to Ireland's Automated Import System (2024)

Many businesses deal with importing goods into Ireland. Navigating the customs procedures of Ireland can occasionally be difficult and time-consuming, particularly for novice traders. Piles of paperwork, long delays, and complicated customs declaration procedures hold you back.

Thankfully, Ireland’s Automated Import System (AIS) makes the process a lot simpler. Since its introduction in November 2020, the AIS has emerged as the main electronic means of submitting customs declarations. Have you ever spent hours filling out countless forms, only to worry that you may have made a mistake? With the AIS, those concerns are a thing of the past.

What research says about automation platforms:

Did you know that 94% of businesses carry out labour-intensive, repetitive tasks? This can be a significant drain on productivity, particularly in the international trading sector. Fortunately, automation provides a solution; kissflow studies show that it has improved jobs for 90% of workers while increasing productivity by 66%.

This blog serves as a comprehensive guide to understanding and utilising the AIS in 2024.

What is an AIS system?

When goods are imported from non-EU nations to Ireland, they require electronic delcaration through the Automated Import System of Ireland’s customs authority. The AIS system oversees data processing, validation, customs declaration, and duty accounting. Also, it makes sure that the products are imported legally, saving you from unexpected fines or penalties.

Why is the AIS import system important?

The significance of AIS cannot be denied, it assists you in the following ways:

Increased efficiency: The Automated Import System replaces the requirement for paper-based customs declarations with an automated system, saving you time and resources.

Mistake reduction: When filing customs declarations manually, there is a chance of mistakes. Incorrect information may lead to further investigations, fines, or delays.

However, with AIS in place, data is validated prior to submission, guaranteeing an error-free procedure.

Cost optimisation: Customs delays may lead to significant hidden costs. You can prevent these expenses by using the AIS, which makes the clearing procedure faster and more effective.

Increased transparency: AIS provides a clear picture of import procedures. With the ability to electronically track the status of your shipment, your company can better allocate the plans ahead. This transparency improves your overall experience, giving you control over your imports.

Feeling overwhelmed by the transition to Ireland’s Automated Import System?

Ensure smooth data transfer and error-free declarations with iCustoms!

Setting up your business to use AIS

The secret to a seamless import process in Ireland is the Automated Import System. However, before you get started, let’s discuss how to set up your company to use the AIS efficiently.

Choosing an external software provider

A lot of businesses provide custom software that is compatible with AIS. This option relieves the pressure of internal development and may be more economical. But be sure to do your homework and pick a reliable supplier that sells software made especially for the AIS. This is when iCustoms becomes useful!

We at iCustoms are committed to making customs procedures easier for companies just like yours. We provide a powerful and intuitive AIS-compatible software system that will simplify your Irish imports.

If you choose the customs agent:

If you decide to entrust the customs agent with handling your import documentation, make sure their software syncs with the AIS. This will eliminate possible data inconsistencies and ensure smooth communication.

Here comes the customs declaration software of iCustoms for customs brokers, which makes sure that it can easily integrate with your system, providing you a seamless trading experience.

Why choose iCustoms as your partner for the Automated Import System?

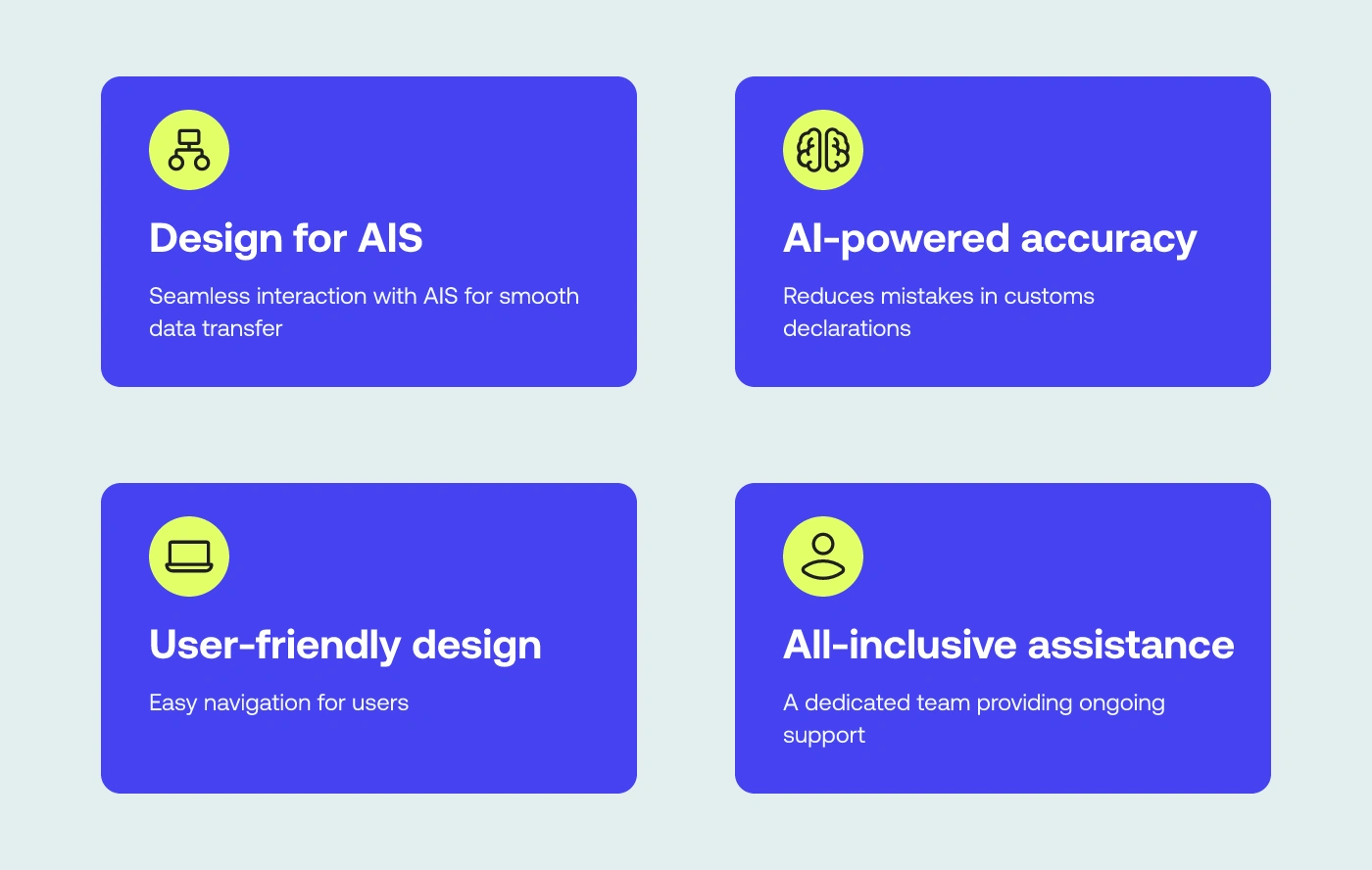

- Design for AIS: Our software was created to interact with the Automated Import System in a seamless manner, guaranteeing smooth data transfer and effective processing.

- AI-powered accuracy: iCustoms reduces the possibility of mistakes in your customs declarations by using cutting-edge AI technology.

- User-friendly design: Even for people who are not familiar with customs procedures, navigating the AIS is a snap because of our user-friendly design.

- All-inclusive assistance: From setup to continuous assistance, our committed team of professionals is ready to help you at every turn.

Tired of import delays and rising costs eating into your profits?

Reduce errors, save time, and gain complete transparency in your shipments with iCustoms’ comprehensive solution.

How iCustoms can benefit you:

- Cust costs: You can save a lot of money and time by doing away with the need for internal software development and training.

- Boost efficiency: Our intuitive software and accuracy driven by AI will help you streamline your import procedure.

- Reduce time spent: Using our integrated validation capabilities, you can steer clear of mistakes and any delays at customs.

- Get peace of mind: You may relax knowing that you have a trustworthy ally at your side to guide you confidently through the AIS.

Takeaways

The Automated Import System (AIS) has transformed the import process in Ireland. By employing this easily navigable electronic system, businesses may guarantee a seamless and effective cross-border movement of commodities. Businesses can have a thorough understanding of the AIS and its features by utilising the data offered by Revenue, which will speed up clearances and save expenses.

Ready to simplify imports into Ireland?

Make iCustoms your reliable partner. To assist businesses in navigating the AIS and guarantee a seamless import procedure, we provide a range of services. To find out more about how we can help you save time and money on your imports, get in touch with us right now.

Unleash the Power of Streamlined AIS Imports!

Get Your Free iCustoms Demo Today

FAQs

What does the AIS do?

The AIS (Automated Import System) handles data processing, validation, clearance of import declarations, and duty calculation.

How to import goods to Ireland?

When importing goods from a non-EU nation to an EU nation, you will require an EORI number, which is needed before clearing customs. Additionally, you must submit an electronic declaration to Irish customs via Customs Declaration Software (CDS).

What are the rules to import in Ireland?

All the imported goods must be declared to Revenue (Irish Government Agency responsible for taxation, customs, and excise) upon arrival in Ireland.