Simplifying EU Exports: A Guide to Centralised Clearance (CCE)

- John Hall

- Customs Specialist at iCustoms.ai

In our increasingly connected global economy, it’s essential for carriers, freight forwarders, and exporters engaged in international trade to manage their trade flows effectively. Within the European Union, the intricate nature of handling export regulations across various Member States can pose significant challenges, especially for exporters dealing with high volumes of transactions or complex logistics. The Centralised Clearance for Export (CCE) initiative has been introduced to tackle these issues, aiming to streamline customs processes and boost operational efficiency in export activities.

By allowing businesses to submit export declarations in a consolidated manner, CCE helps reduce the heavy administrative burden that often accompanies cross-border trade. This modernisation aligns with the EU’s broader goal of simplifying customs procedures and helping companies adapt to a more digital trading landscape. For carriers and importers operating in multiple Member States, the ability to manage their customs processes under a single authority offers a key opportunity to improve logistical and operational coordination.

As CCE rolls out across the EU, it is set to become an essential tool for exporters looking to enhance their customs operations. As Member States prepare for its implementation, it’s vital for businesses to fully understand the CCE framework and its eligibility requirements to remain competitive in this ever-changing commercial environment.

What is CCE?

Centralised Clearance for Export (CCE), introduced under the EU Customs Code (UCC), simplifies export procedures by allowing businesses to submit export declarations in their home Member State, even when goods are located elsewhere in the EU. This eliminates the need for multiple submissions, reducing administrative complexity and improving efficiency.

CCE operates through coordination between customs offices: the export office (often in Belgium) manages submission and communication, while the Presentation Customs Office (PCO) in the country where goods are located handles inspections. In some cases, a supervising custom office (SCO) oversees the process, ensuring smooth, compliant operations.

Applicable to most declaration types (excluding B and E), CCE supports pre-lodged and simplified declarations and integrates digital systems for real-time data exchange between customs authorities.

To benefit fully, businesses must ensure accurate location data, authorisation codes, and EORI details, as errors can cause delays or compliance issues.

CCE Success Starts Here: Watch a Demo

How Does CCE Work?

CCE works with many customs offices that have specific roles in the procedure. The export office is usually in the member state where the declarant is located. It serves as the main contact for the exporter and handles the export declaration. Meanwhile, the presentation office in the Member State where the goods are located conducts required inspections or verifications. This checks if the goods meet customs laws.

When extra supervision is required, someone can designate a supervising office. This office handles all steps of the export process. It also shares important information between the customs offices involved. Modern computer systems allow data to flow smoothly between offices. This ensures real-time communication and reduces processing delays.

A key part of CCE is that it can make declarations centrally. At the same time, it meets the local customs where the goods are located. To meet procedural requirements, the declarant must provide accurate information. This includes the location of goods, authorisation codes, and EORI numbers. Such information has to be properly entered into the declaration system to prevent any mistakes that may disrupt the clearance process.

CCE will help reduce the administrative burden on exporters. It will create a network of customs offices to ensure compliance with EU customs rules. This model of collaboration helps in facilitating effective and safe trade between member states.

Types of AEO Authorisations under the Union Customs Code (UCC)

There are three main types of Authorised Economic Operator (AEO) authorisations under the Union Customs Code (UCC):

- AEO-C (Customs Simplifications) – Revolves around the compliance with customs, as the traders will enjoy a simpler customs process, fewer document checks, and prompt clearance.

- AEO-S (Security and Safety) – Focuses on the security of supply chains. It is appropriate for companies that deal with high-risk or extensive logistics, and it provides fewer physical checks and a high-level treatment of borders.

- AEO-F (Full Authorisation) – AEO-F is also called a combined certification because this qualification combines the advantages of AEO-C and AEO-S. It is the most advanced state of AEO status, and it shows complete adherence to the customs and security standards.

Unlock CCE & AEO: See the Automation

Three Main Types of AEO Authorisations (UCC)

| AEO Authorisation | Focus | Key Benefit | Prerequisite for CCE? |

| AEO-C (Customs Simplifications) | Customs compliance | Simplified customs procedures, fewer document checks, and faster clearance. | Yes (Often) |

| AEO-S (Security and Safety) | Supply chain security | Reduced physical inspections and priority treatment at borders. | Generally No |

| AEO-F (Full Authorisation) | Combined (Customs & Security) | Merges the benefits of both AEO-C and AEO-S (the Highest level of status). | Yes (Often) |

Who is eligible for CCE?

Centralised Clearance for Export (CCE) can only be applied by companies that are authorised economic operators (AEOs). The process of authorisation involves the presentation of businesses with elaborate documentation, such as evidence of adherence to customs regulations and the reliability of operations. Companies are also obliged to consult with the customs authorities to show their willingness to address all the requirements of the procedure and the technical specifications.

Within the application, businesses are required to demonstrate that they can handle export business in accordance with the EU Customs Code. One of the important features is the use of the authorisation code C513 in the export declarations, as well as the EORI number of the company that identifies the authorised operator. Other Member States may also include other licence numbers as part of the authorisation reference, including Luxembourg and the Netherlands.

The applicants should make sure that their internal systems are capable of managing CCE requirements, such as proper entry of the location of goods and other relevant customs offices. Any mistakes or omissions can contribute to the delay or rejection of the application.

Although the process is stringent, it has the advantage of making sure that only qualified, compliant, and well-prepared businesses are the beneficiaries of the efficiencies associated with centralised export clearance in the EU.

What Does CCE Mean for Your Customs Flows?

Centralised Clearance for Export (CCE) helps exporters streamline customs operations in the EU. Filing export statements with one customs office makes cross-border trade easier for businesses in multiple Member States. The centralised method will show a clearer view of custom processes. This will improve coordination and boost overall operational effectiveness.

A centralised system for export clearance helps companies with diverse supply chains be more flexible. This makes them more responsive to logistical needs. Mistakes in handling declarations across countries are kept to a minimum. This is because all submissions occur in a familiar environment. It’s often integrated with the company’s ERP system.

In addition, CCE adoption facilitates the adoption of digital customs tools, which allow the real-time sharing of data among customs offices. This reduces delays in processing. It also ensures goods cross borders smoothly and follow EU regulations. The companies can now do business faster and more accurately, with confidence in their exports.

Administrative burdens are lowered, and companies can engage in the optimisation of other spheres of their work. Close coordination of internal systems is key. Also, following the authorisation requirements is necessary for successful implementation.

What’s Coming?

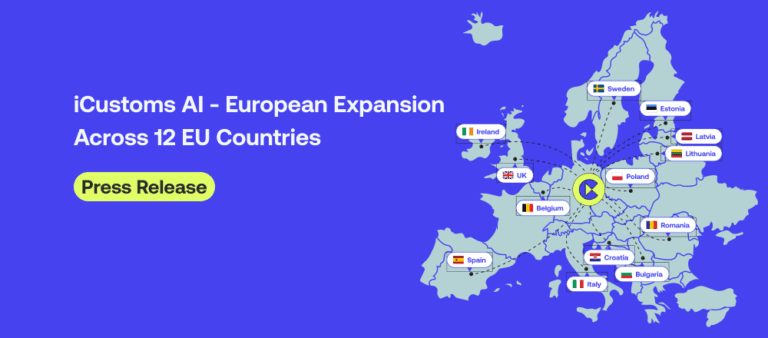

By the end of 2025, AEO-certified companies with Centralised Clearance (CC) authorisation can lodge all export declarations through one chosen EU Member State, even if goods are physically in another. This simplifies cross-border procedures and supports fully digital, harmonised customs operations.

Here Comes iCustoms — Your Partner in CCE Success.

To ensure your business fully leverages the benefits of Centralised Clearance for Export (CCE) and other advanced customs processes, having the right tools and insights is key. This is where iCustoms comes in.

Our Customs Management platform acts as a central hub for tailored solutions, automation, and up-to-date compliance support. From guiding you through authorisation requirements to integrating digital customs systems with your ERP environment, iCustoms provides a unified space to simplify your export operations.

Whether you’re preparing for CCE implementation or enhancing your EU Customs Filing workflows, iCustoms delivers the expertise and digital tools your business needs to stay compliant, efficient, and future-ready.

Prepare for CCE: Watch Your iCustoms Demo

Conclusion

The Centralised Clearance for Export (CCE) is an important move towards streamlining and harmonising the EU customs processes. It enables businesses to make export declarations with a single supervising office, which reduces administrative work and enhances efficiency.

CCE eliminates mistakes, accelerates clearance, and boosts the coordination of supply chains of companies that have to do business in more than one Member State. Through digital integration, digital customs offices can share any data in real time, and this enables exporters to be compliant and flexible.

With the spread of CCE throughout the EU, companies ought to assess their preparedness and internalise its technical and procedural demands. iCustoms assists the organisations in the seamless conformance via the digital customs systems and automation of the processes.

Ready to simplify your Centralised Clearance Exports process?

From accuracy to automation, iCustoms keeps your business compliant and ahead.

You may also like:

Struggling to Extract, Catagorise & Validate Your Documents?

Capture & Upload Data in Seconds with AI & Machine Learning

Subscribe to our Newsletter

About iCustoms

iCustoms is an all-in-one solution helping businesses automate customs processes more efficiently. With AI-powered and machine-learning capabilities, iCustoms is designed to streamline your all customs procedures in a few minutes, cut additional costs and save time.

Struggling to Extract, Catagorise & Validate Your Documents?

Capture & Upload Data in Seconds with AI & Machine Learning