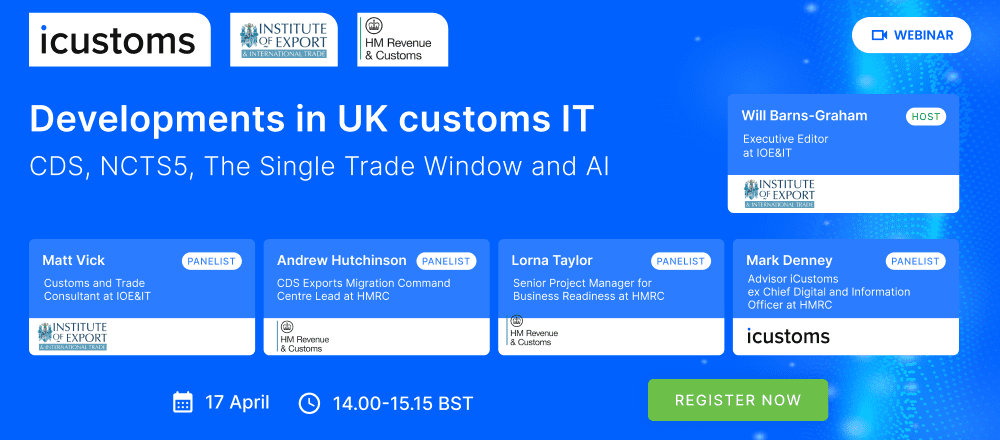

Developments in UK customs IT – CDS, NCTS5, the Single Trade Window and AI Join the speakers from HMRC and iCustoms for a webinar presented by the Institute of Export and International Trade (IOE&IT) in association with iCustoms. The UK’s border strategy is undergoing significant development. You will gain the knowledge necessary to negotiate impending… Continue reading Developments in UK customs IT – CDS, NCTS5, the Single Trade Window and AI

Developments in UK customs IT – CDS, NCTS5, the Single Trade Window and AI